In the rapidly evolving world of digital assets, Bitcoin (BTC) has consistently maintained its position as the undisputed leader of the cryptocurrency market. Despite the proliferation of alternative cryptocurrencies (altcoins) and continuous innovation in blockchain technology, Bitcoin remains the most recognized, trusted, and valuable digital currency as we enter 2024. But what makes Bitcoin the dominant force in the cryptocurrency landscape, even after more than a decade since its creation? This article explores the key factors that contribute to Bitcoin’s continued supremacy.

1. First-Mover Advantage and Strong Brand Recognition

Bitcoin, created in 2009 by the mysterious Satoshi Takemoto, was the first cryptocurrency to introduce the concept of decentralized digital money. This first-mover advantage has provided Bitcoin with unparalleled brand recognition and a lasting sense of trust among investors. For many, Bitcoin is synonymous with cryptocurrency itself. Even as newer projects with advanced features continue to emerge, Bitcoin’s iconic status and reputation as the pioneer of the digital currency revolution continue to attract both retail and institutional investors alike.

2. Decentralization and Robust Security

A core strength of Bitcoin lies in its decentralized structure. Unlike many altcoins that are often controlled by centralized entities or development teams, Bitcoin operates on a distributed network of nodes and miners. This decentralized nature ensures that no single entity has the power to manipulate or control the Bitcoin network, making it one of the most secure and censorship-resistant cryptocurrencies in existence.

Furthermore, Bitcoin’s proof-of-work (PoW) consensus mechanism, while energy-intensive, has proven to be one of the most secure and battle-tested systems in blockchain technology. The immense computational power required to attack the Bitcoin network makes it highly resistant to hacking, further establishing its reputation as a reliable store of value.

3. Scarcity and Its Role as a Store of Value

Bitcoin’s fixed supply cap of 21 million coins is fundamental to its value proposition. This built-in scarcity mirrors the properties of precious metals like gold, earning Bitcoin the nickname “digital gold.” In an era where central banks continue to expand the money supply through fiat currency printing, Bitcoin’s deflationary model offers a hedge against inflation and currency devaluation.

The upcoming 2024 Bitcoin halving event, which will reduce the block reward for miners, further emphasizes Bitcoin’s limited supply. As the issuance of new Bitcoins decreases, the asset becomes increasingly attractive to long-term investors seeking a store of value that is resistant to inflationary pressures.

4. Institutional Adoption and Widespread Acceptance

In recent years, Bitcoin has garnered significant interest from institutional investors and major corporations. Notable companies like Tesla, MicroStrategy, and Square have added Bitcoin to their balance sheets, while financial giants like BlackRock and Fidelity have launched Bitcoin-based investment products. This institutional adoption has not only enhanced Bitcoin’s legitimacy but has also propelled its price to new heights.

Additionally, Bitcoin’s acceptance as a means of payment continues to expand. From online retailers to travel agencies, businesses across the globe are integrating Bitcoin into their payment systems, further solidifying its role as a trusted currency in the global economy.

5. Promoting Global Financial Inclusion

Bitcoin has emerged as a powerful tool for financial inclusion, especially in regions where traditional banking systems are either inefficient or inaccessible. In countries such as Venezuela, Argentina, and Nigeria, Bitcoin provides individuals with an alternative way to preserve wealth and conduct cross-border transactions without relying on corrupt or ineffective financial institutions.

Moreover, the rise of decentralized finance (DeFi) platforms and Bitcoin-based financial services has expanded access to crucial financial tools for the unbanked and underbanked populations, reinforcing Bitcoin’s role as a transformative global currency.

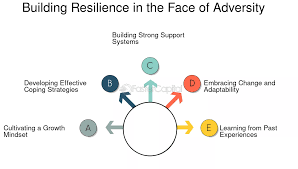

6. Resilience Amidst Adversity

Over the years, Bitcoin has weathered numerous challenges, including regulatory scrutiny, market volatility, and technological competition. Despite these obstacles, Bitcoin has consistently bounced back, proving its resilience and long-term viability. In 2024, as governments around the world grapple with the complexities of regulating cryptocurrencies, Bitcoin’s decentralized structure and widespread adoption make it a difficult asset to suppress or replace.

7. The Network Effect and Liquidity Advantage

Bitcoin benefits from the most robust network effect in the cryptocurrency space. With the largest user base, the highest trading volume, and the largest market capitalization, Bitcoin is the most liquid and widely traded cryptocurrency. This liquidity makes it the preferred asset for investors, traders, and institutions, reinforcing its dominance in the market.

8. Technological Stability and Predictability

While some critics argue that Bitcoin’s technology is less advanced compared to newer blockchains, its simplicity and predictability remain key advantages. Bitcoin’s core protocol has remained largely unchanged over the years, ensuring stability and reliability. In contrast, many altcoins undergo frequent updates and forks, creating uncertainty for both users and investors.

Conclusion

As we continue into 2024, Bitcoin’s position as the leader in the cryptocurrency space remains steadfast. Its first-mover advantage, decentralized architecture, scarcity, institutional adoption, and resilience have solidified its status as a unique and enduring asset in the digital age. While the broader cryptocurrency landscape will continue to evolve, Bitcoin’s role as a store of value, medium of exchange, and symbol of financial freedom ensures that it will remain at the forefront of the blockchain revolution for years to come.